Summary-

Australian bank hybrids continued to attract strong investor interest today, with prices holding above par and running yields offering competitive income across the board. The standout performer was Judo Capital’s JDOPA, delivering a 9.60% running yield and a 4.60% trading margin, reflecting its higher risk premium and appeal for yield-focused investors.

Top 5 Bank Hybrids by Running Yield

- Macquarie Group (MQGPD) — 7.56% yield, 0.45% margin, 102.95 close

- National Australia Bank (NABPF) — 7.48% yield, 0.49% margin, 101.94 close

- Westpac (WBCPJ) — 6.84% yield, 1.18% margin, 102.80 close

- Commonwealth Bank (CBAPI) — 6.47% yield, 1.12% margin, 102.50 close

- ANZ (AN3PI) — 6.41% yield, 1.36% margin, 103.50 close

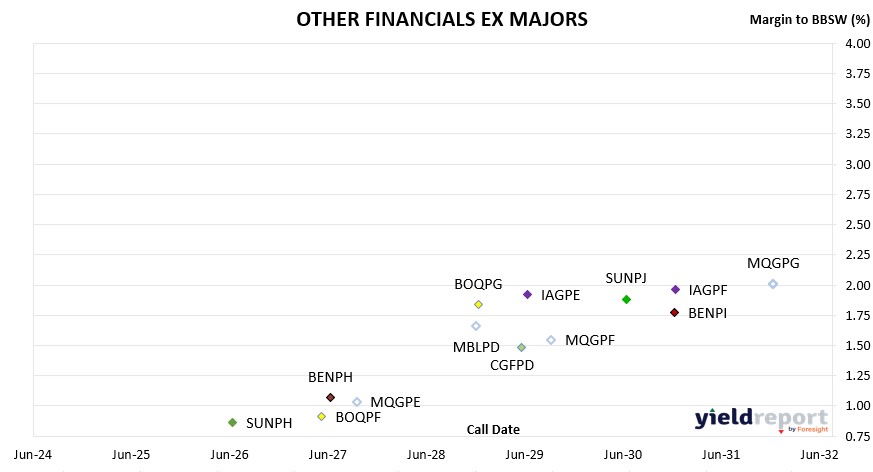

These hybrids traded firmly above par, signaling strong demand and confidence in bank credit quality. Regional banks such as Bank of Queensland and Bendigo Bank remained competitive, posting yields near 7.1%, positioning them as a middle ground between the Big Four and smaller issuers.

Key Market Trends

- Running yields: Mostly 6.1%–7.6% for major banks; JDOPA stands out at 9.60%.

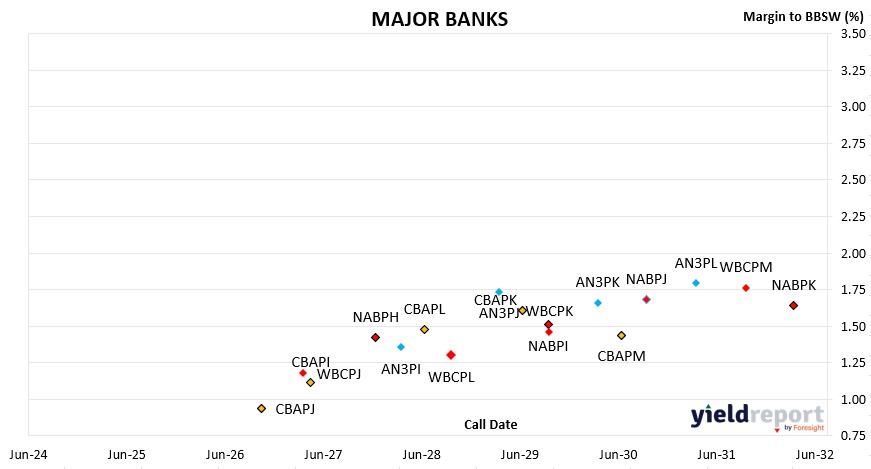

- Trading margins: Tight spreads on short-dated hybrids (~0.9%–1.3%), wider margins on longer-dated issues (~1.6%–2.0%).

- Prices: Predominantly above par (102–107), underscoring robust demand and confidence in bank credit quality.

- Call date impact: Near-term calls (2026–2028) generally carry lower margins, while longer-dated hybrids (2030–2032) show higher spreads.

For income investors, today’s data suggests opportunities in Macquarie and NAB hybrids for those seeking strong yields with relatively low margins, while JDOPA offers the highest return for those comfortable with elevated risk. Regional banks provide a balanced alternative for those looking beyond the Big Four.

-

COMPANY CODE HYBRID TYPE MATURITY/

CALL

DATEMARGIN

INCL. CREDITSTRADING

MARGINDAY

CLOSERUNNING

YIELD**Challenger CGFPC Capital Notes 3 25/05/2026 4.60% -0.41% 102.66 8.02% Nat Aust Bank NABPF Capital Notes 3 17/06/2026 4.00% 0.49% 101.94 7.48% Suncorp SUNPH Capital Notes 3 17/06/2026 3.00% 0.86% 101.13 6.56% Macquarie Group MQGPD Capital Notes 4 10/09/2026 4.15% 0.45% 102.95 7.56% CBA CBAPJ PERLS 13 20/10/2026 2.75% 0.94% 101.56 6.29% Latitude LFSPA Capital Notes 27/10/2026 4.75% 6.20% 98.50 8.49% Westpac WBCPJ Capital Notes 7 22/03/2027 3.40% 1.18% 102.80 6.84% CBA CBAPI PERLS 12 20/04/2027 3.00% 1.12% 102.50 6.47% Bank of Queensland BOQPF Capital Notes 2 14/05/2027 3.80% 0.91% 104.19 7.14% Bendigo Bank BENPH Capital Notes 15/06/2027 3.80% 1.07% 104.02 7.14% Macquarie Group MQGPE Capital Notes 5 20/09/2027 2.90% 1.04% 102.70 6.33% Nat Aust Bank NABPH Capital Notes 5 17/12/2027 3.50% 1.42% 103.94 6.86% ANZ Bank AN3PI Capital Notes 6 20/03/2028 3.00% 1.36% 103.50 6.41% CBA CBAPL PERLS 15 15/06/2028 2.85% 1.48% 103.18 6.28% Suncorp SUNPI Capital Notes 4 17/06/2028 2.90% 1.56% 103.10 6.34% Westpac WBCPL Capital Notes 9 22/09/2028 3.40% 1.30% 105.30 6.68% Macquarie Bank MBLPD Capital Notes 3 7/12/2028 2.90% 1.66% 103.40 6.32% Bank of Queensland BOQPG Capital Notes 3 15/12/2028 3.40% 1.84% 104.20 6.75% Judo Capital JDOPA Capital Notes 16/02/2029 6.50% 4.60% 111.71 9.60% ANZ Bank AN3PJ Capital Notes 7 20/03/2029 2.70% 1.73% 102.85 6.16% Challenger CGFPD Capital Notes 4 25/05/2029 3.60% 1.48% 106.50 6.80% CBA CBAPK PERLS 14 15/06/2029 2.75% 1.61% 103.54 6.17% IAG IAGPE Capital Notes 2 15/06/2029 3.50% 1.92% 104.90 6.80% Macquarie Group MQGPF Capital Notes 6 12/09/2029 3.70% 1.54% 107.00 6.85% Nat Aust Bank NABPI Capital Notes 6 17/09/2029 3.15% 1.51% 105.34 6.44% Westpac WBCPK Capital Notes 8 21/09/2029 2.90% 1.46% 104.74 6.24% ANZ Bank AN3PK Capital Notes 8 20/03/2030 2.75% 1.66% 104.00 6.14% CBA CBAPM PERLS 16 17/06/2030 3.00% 1.44% 105.92 6.26% Suncorp SUNPJ Capital Notes 5 17/06/2030 2.80% 1.88% 103.51 6.22% Nat Aust Bank NABPJ Capital Notes 7 17/09/2030 2.80% 1.68% 104.46 6.16% Bendigo Bank BENPi Capital Notes 2 13/12/2030 3.20% 1.77% 105.85 6.46% Insurance Australia IAGPF Capital Notes 3 15/12/2030 3.20% 1.96% 105.14 6.50% ANZ Bank AN3PL Capital Notes 9 20/03/2031 2.90% 1.79% 104.78 6.24% Westpac WBCPM Capital Notes 10 22/09/2031 3.10% 1.76% 106.14 6.34% Macquarie Group MQGPG Capital Notes 7 15/12/2031 2.65% 2.01% 103.15 6.09% Nat Aust Bank NABPK Capital Notes 8 17/03/2032 2.60% 1.64% 104.76 5.95% -

COMPANY CODE BOND TYPE CALL DATE ISSUE MARGIN (inc frank) TRADING MARGIN CLOSING PRICE RUNNING YIELD Nufarm NFNG Step Up Perpetual 3.90% 5.06% 88 8.71% Ramsay Health Care RHCPA Preference Share Perpetual 4.85% 4.42% 106.75 8.06%