| Close | Previous Close | Change | |

|---|---|---|---|

| Australian 3-year bond (%) | 3.697 | 3.646 | 0.051 |

| Australian 10-year bond (%) | 4.405 | 4.355 | 0.05 |

| Australian 30-year bond (%) | 5.027 | 4.993 | 0.034 |

| United States 2-year bond (%) | 3.597 | 3.576 | 0.021 |

| United States 10-year bond (%) | 4.132 | 4.108 | 0.024 |

| United States 30-year bond (%) | 4.7299 | 4.7044 | 0.0255 |

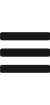

Overview of the Australian Bond Market

Australian government bond yields rose on November 10, 2025, amid global risk-on from US shutdown progress, pressuring havens as equities rallied. The 10-year yield climbed four basis points to 4.38%, 5-year up four to 3.85%, 2-year up four to 3.62%, 15-year up two to 4.69%. Moves echoed Nasdaq surge influencing ASX tech +2.4%, with AUD/USD up 0.5% to 0.6528 on sentiment.

September trade surplus below poll but export growth signaled resilience, RBA hold at 3.6%. PMIs mild expansion. Global: Senate deal potentially resuming US data like jobs, aiding Fed cuts (60% December), per City’s Fiona Cincotta. Fed split: Musalem caution, Daly high rates risk, Miran for cut.

China outlook upgrade boosted commodities, oil +0.7%, gold +2.8%. Tariff deals ease drags.

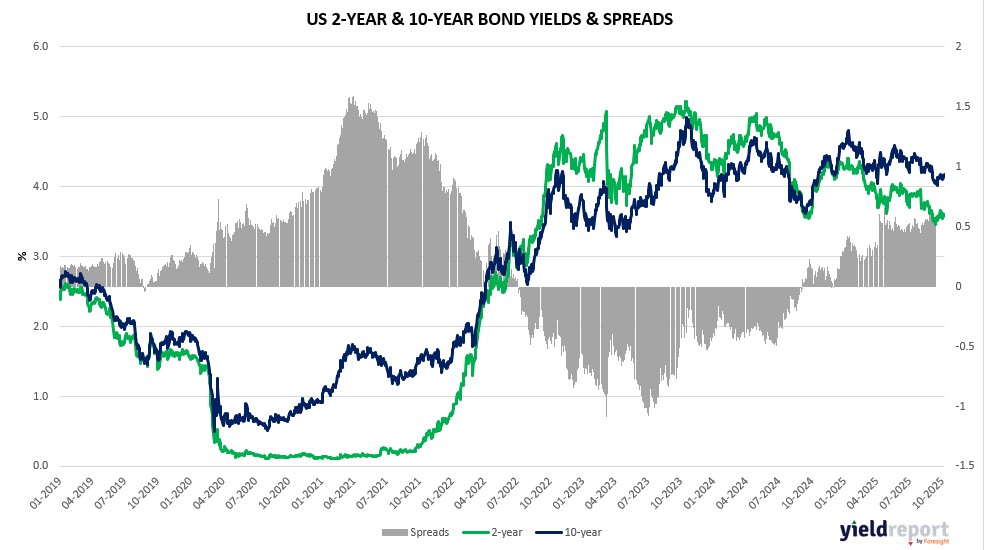

Overview of the US Bond Market

Treasury yields climbed on November 10, 2025, as shutdown deal progress spurred risk-on, diminishing safety demand while auctions loom. The 10-year yield rose two basis points to 4.11%, 2-year up three to 3.59%, 30-year little changed at 4.70%, flattening the curve amid equity surge. Session reflected Senate advance potentially reopening government, resuming data like delayed September jobs, aiding Fed’s December decision with 60% cut odds.

Shutdown’s 40-day toll, costing $15 billion weekly and 1.5% Q4 GDP drag per CBO, amplified labor concerns; private alternatives filled voids but inflation proxies limited. Fed’s Powell noted no December cut certainty, with officials split: Musalem cautious on resilient economy/accommodative conditions, Daly on demand downturn risks, Miran for cut on drifting unemployment. Traders eye Veterans Day closure, $125 billion auctions testing demand.

Tariff clarity via deals, like China’s conditional SQM-Codelco approval boosting lithium, eased global drags; oil up 0.7% to $60.15, gold 2.8% to $4,112 as havens. Bloomberg Dollar Spot flat.

BMO’s Vail Hartman saw weeks for full data post-reopen, quality concerns into 2026 elevating private metrics. Evercore’s Guha noted September jobs first, aiding cut likelihood on soft market. Morgan Stanley’s Michael Gapen anticipated 1-2 week inflation/spending delays. UBS’s Mark Haefele favored stocks on easing/earnings, quality bonds for risk-reward. TD’s Oscar Munoz expected repetitive Fedspeak pre-meeting. JPMorgan survey showed shrinking longs; CFTC: asset managers pared longs $23.5M/bp in 5/10-year, leveraged funds cut shorts. Dealers uniform on steady August-October sizes, per April guidance. Goldman’s chief strategist: tariffs could bite equities despite deals, urging diversification amid high valuations/resilience dodging recession.